Common Difficulties:

CPP says I’m not “Disabled” according to the Plan

To be eligible for the CPP disability benefit you have to prove your condition meets the definition of disability under the Plan. This can be difficult for someone with a progressive disease to meet because you must prove that you cannot do any type of substantially gainful occupation. Although your symptoms are affecting your job, your condition may not yet at the point where you cannot do any work.

Example: Applying Too Early for CPP Disability Benefits:

Parwinder wanted to stop working full-time because she found her Parkinson’s symptoms made working difficult. She applied for CPP disability benefits to supplement her income while she worked part-time. Her application was denied. CPP concluded that Parwinder’s medical condition did not meet the definition of ‘disability’ in the legislation: she was still able to work when she applied.

If you have a private pension plan through your employer, the definition of “disabled” may be different and easier to meet than the definition in the Canada Pension Plan. This is worth exploring with your employer’s pension administrator.

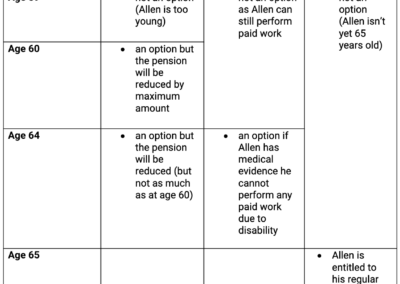

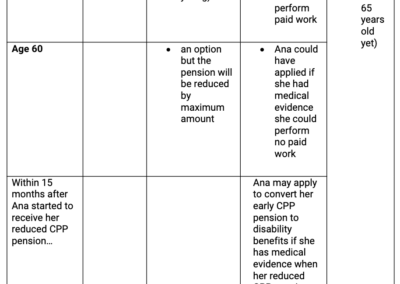

I am already receiving an early CPP retirement pension but now I’m disabled

The decision to elect to receive an early CPP retirement pension is generally one you cannot change.

There is one critical exception: you can apply to convert your CPP retirement pension into CPP disability benefits within the first 15 months of receiving the retirement pension payments. However, you must show that you were disabled for the purpose of the CPP at the time you first elected to receive the CPP retirement pension. This can be difficult to do if you do not have detailed medical records from that time.

Example:

Ana was diagnosed with Parkinson’s disease at age 51. Fortunately, she was doing very well for many years. At age 60, Ana decided to take an early CPP pension. She was very disabled at this time but did not know she may be eligible for CPP disability benefits which would give her more money each month. Later that year, Ana learned she could apply to convert her retirement pension into CPP disability benefits if she had enough medical evidence from the time she first received her pension benefits and if she acted quickly.

What to do if your application for CPP Disability Benefits is denied

If your application for CPP disability benefits is denied, you may have the decision reviewed. It is beyond the scope of this information sheet to discuss what the grounds for review are applicable in any specific case. You will need to show that CPP has not applied the legislation correctly or has misunderstood your medical evidence in refusing your application.

Generally, you may only appeal the decision to court after you have exhausted all three of the CPP internal appeal processes. The CPP internal appeal processes are:

- Submit a request for reconsideration of a decision to Service Canada within 90 days of receiving your initial decision;

- If you are unsuccessful, submit an appeal to the General Division (first level of appeal) of the Social Security Tribunal of Canada; and

- If you are unsuccessful, submit a permission to appeal to the Appeal Division (second level of appeal) of the Social Security Tribunal of Canada.

Each stage has strict timelines that can rarely be extended:

- The request for reconsideration must be made within 90 days of receiving the decision that your application was denied.

- If you are unsuccessful, you can appeal to the General Division of the Social Security Tribunal of Canada within 90 days of the reconsideration decision.

- If you are not successful at the General Division, you have 90 days to apply for permission to appeal to the Appeal Division of the Social Security Tribunal of Canada.

- If you are also unsuccessful at the Appeal Division, you may apply to the Federal Court for judicial review of the decision within 30 days.

Generally, on a judicial review, the Court considers the material you put before the CPP, whether the CPP officials followed the legislation properly and whether the process met general legal principles of fairness. The most typical remedy a Court will grant on a judicial review is to require the CPP to reconsider your application. A judicial review application requires special expertise in administrative law.

Please seek legal advice on how to frame your appeal early in the process to maximize your chances for success. If you wait until judicial review for legal advice, you may have lost the opportunity to improve your case.

A note on other pension plans

If you work in the public sector, you may be eligible for a public sector retirement pension or a disability pension. These plans have different requirements than CPP. You should ask your pension plan provider for more information.

If you work in the private sector, you may have a private pension plan. The Pension Benefits Standards Act (BC) requires these plans to provide disability pensions if a plan member has a disability that is likely to considerably shorten his or her life expectancy. Each plan is different and the definition of disability in your plan may be easier to meet than under the CPP. You should request more information from your employer’s pension plan administrator.

Other considerations: Provincial Disability Assistance Benefits

In British Columbia, the Ministry of Social Development and Poverty Reduction currently provides social benefits for people with disabilities. This is called the Person with Disabilities (PWD) benefit. If you qualify, you receive a monthly income and other benefits like low-cost transit passes or improved health and prescription drug coverage.

To qualify for a PWD benefit, you must show that you have a severe mental or physical impairment that significantly restricts your ability to perform daily living activities (such that you need assistance) and this impairment is expected to last more than two years. You must also meet the financial eligibility requirements. Currently, if you are a single, couple, or family where one person has the PWD designation, you are financially eligible if your liquid assets do not exceed $100,000 (that is, your bank accounts, RRSP, or Tax Free Savings Account). If you are a couple or family where both adults have the PWD designation, you are financially eligible if both adults’ liquid assets do not exceed $200,000. Your home, vehicle, and other assets will be exempt from the qualifying limits (these are “exempt assets”). For more information on eligibility and asset limits, contact the Ministry of Social Development and Poverty Reduction.

The PWD benefit is a prescribed monthly amount. In 2025, you could get up to $1,483.50 for a single person to $2,548.50 for a couple where both have the PWD designation.

If you qualify, you receive a monthly income and other benefits like low-cost transit passes or improved health and prescription drug coverage.

Helpful Resources

- Canada Pension Plan has a comprehensive website through Service Canada https://www.canada.ca/en/services/benefits/publicpensions/cpp.html

- Service Canada considers CPP and CPP disability applications and reconsideration requests. The application forms are also available on the website at www.servicecanada.gc.ca

- BC Pension Corporation is responsible for the administration of BC’s College, Municipal, Public Service, Teachers’ and WorkSafeBC pension plans. www.pensionsbc.ca

- Access Pro Bono helps individuals find lawyers who are willing to take on work without charging fees (“pro bono”). www.accessprobono.ca

Prepared by Blake, Cassels & Graydon LLP. Last updated: October 8, 2025